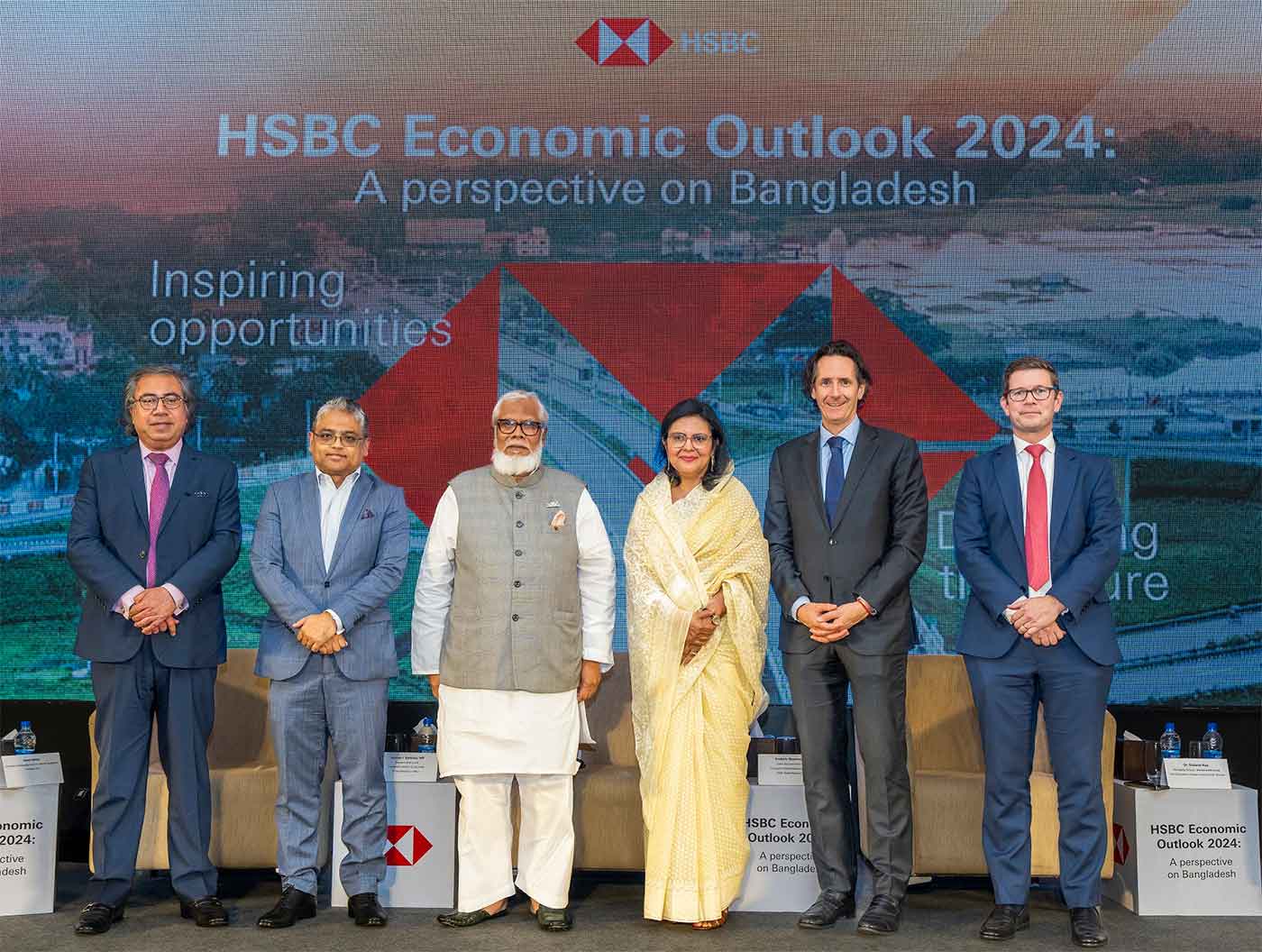

The event featured a keynote presentation by Frederic Neumann, Chief Asia Economist and Co-Head of Global Research Asia, HSBC where he shared insights on the latest macroeconomic outlook. Salman F Rahman, MP, Private Industry and Investment Adviser to the Honourable Prime Minister, Prime Minister Office, attended as the Chief Guest. Dr Rubana Huq, Managing Director, Mohammadi Group and Vice-Chancellor, Asian University for Women, and Zaved Akhtar, Chairman and Managing Director, Unilever Bangladesh and President, Foreign Investors’ Chamber of Commerce and Industry (FICCI) were the key speakers at the event. The event was also attended by Md Mahbub ur Rahman, Chief Executive Officer, HSBC Bangladesh and Gerard Haughey, Country Head of Wholesale Banking, HSBC Bangladesh. Over 200 clients and stakeholders, representatives from embassies, regulators and government officials were also in attendance at the event.

During the keynote presentation, Frederic Neumann highlighted the near-record high foreign direct investments flowing into Asia and stressed the need for Bangladesh to capitalise on this opportunity. He also presented a Global Economic Policy Index that graphically represented the global uncertainties over the years. The index peaking during the pandemic posed multifaceted challenges which Bangladesh emerged with resilience. HSBC expects Bangladesh’s GDP growth of 5.9% for this coming fiscal year, and 6.3% for fiscal year thereafter. He added, the average incremental GDP in the next four years will be around USD 80 which is more than the predicted GDP of Saudi Arabia and many other Asian peers. The acceleration in growth should be supported by household spending and improving purchasing power amid easing inflation pressures. Meanwhile, remittances are expected to rebound as well, driven by an improving global outlook, helping to further support consumption. Investment spending, too, is expected to pick up, led by exporters who are benefitting from the improving global trade cycle. The outlook for Bangladesh remains bright, with growth expected to improve further as fiscal and structural reforms gain traction. An interactive question and answer session followed which opened the floor for further elaboration on the subject matter.